Genting Malaysia takes full control of Empire Resorts from Lim family in US$41 mil deal

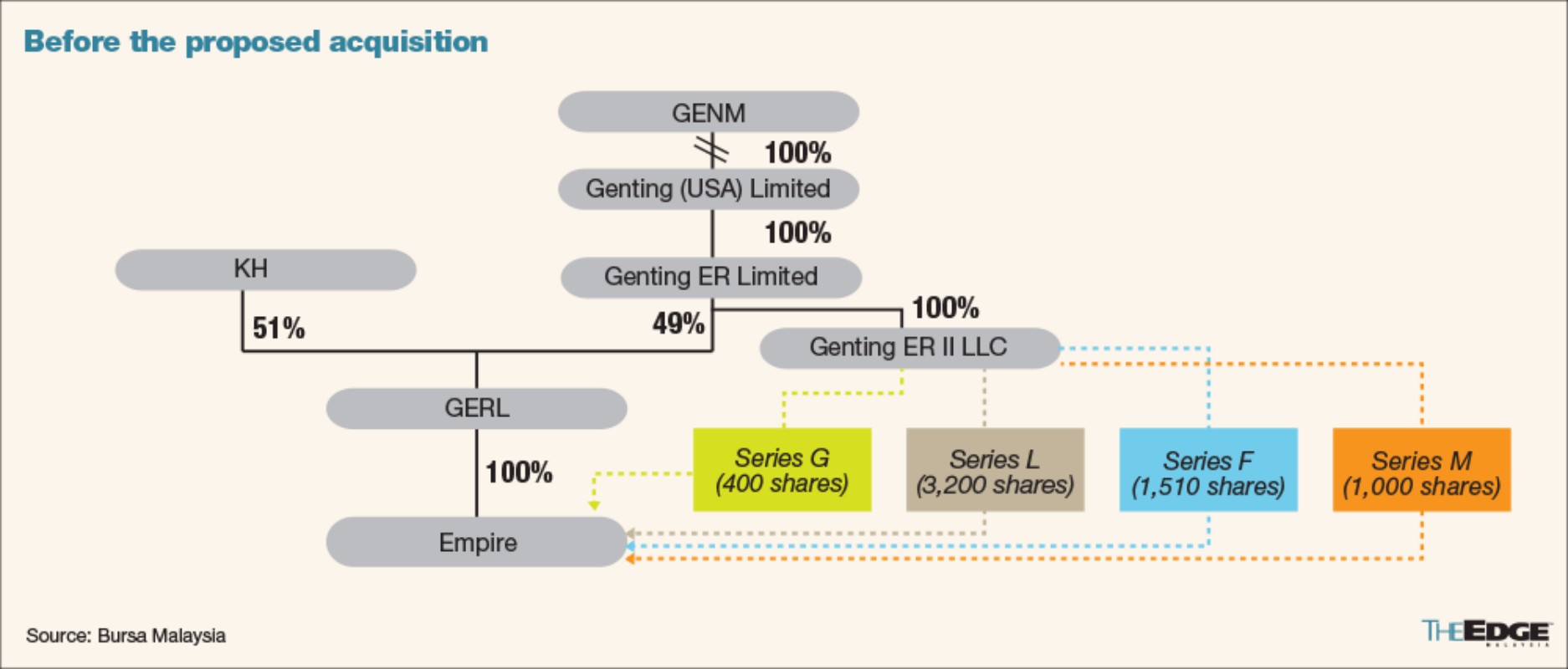

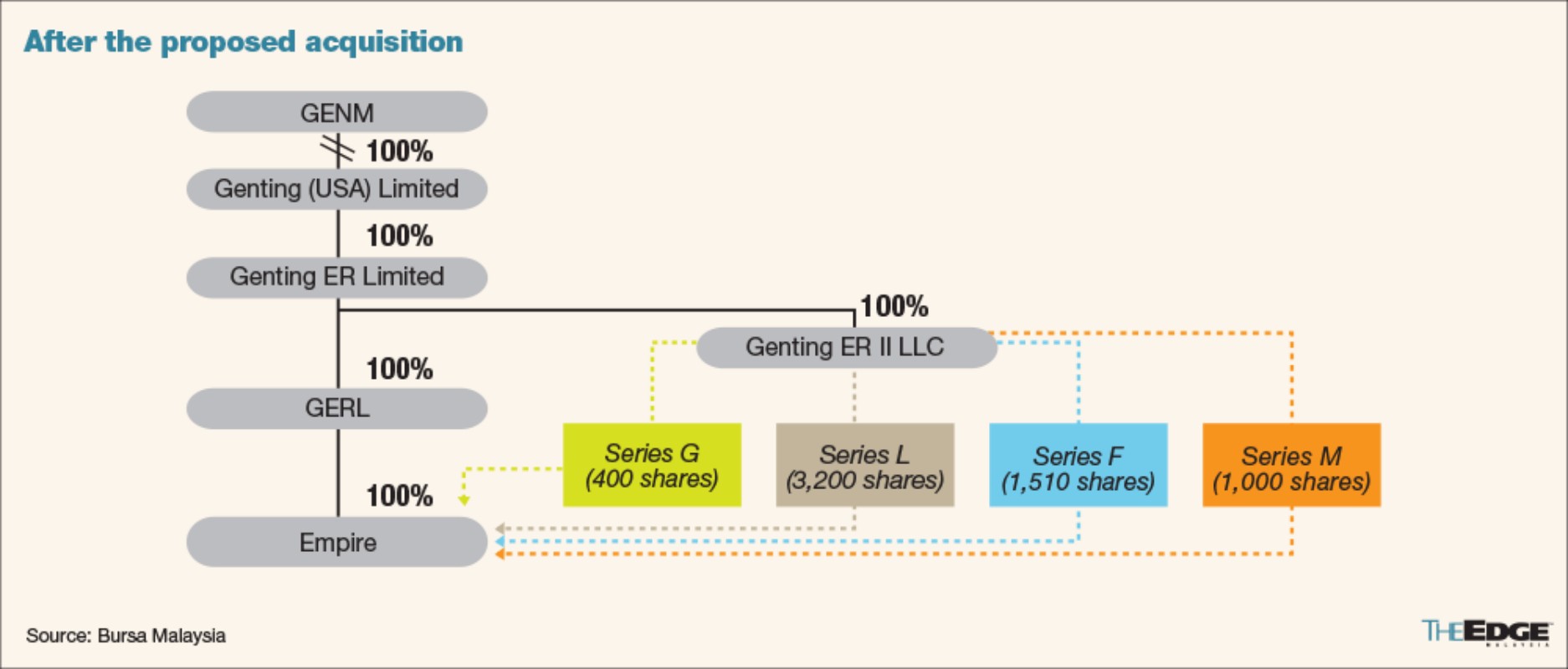

KUALA LUMPUR (May 2): Genting Malaysia Bhd (KL:GENM) is going to gain full control of loss-making Empire Resorts Inc in a US$41 million (RM177 million) deal from the Lim family's Kien Huat Realty III Ltd, by acquiring the remaining 51% stake in Genting Empire Resorts LLC (GERL) that it does not own. It currently holds 49% interest in GERL, which owns Empire Resorts.

Concurrently, Kien Huat Realty III will assign a US$39.7 million debt — including accrued interest — that Empire Resorts owes to Genting Malaysia. Kien Huat Realty III is controlled by Genting group's founding Lim family, led by Tan Sri Lim Kok Thay.

The transaction, announced by Genting Malaysia on Friday via a bourse filing, will result in Empire Resorts becoming an indirect wholly owned subsidiary of Genting Malaysia, via Genting ER Ltd.

Empire Resorts owns and operates integrated casino Resorts World Catskills and video lottery terminal Resorts World Hudson Valley, along with Resorts World Bet, a mobile sports betting platform.

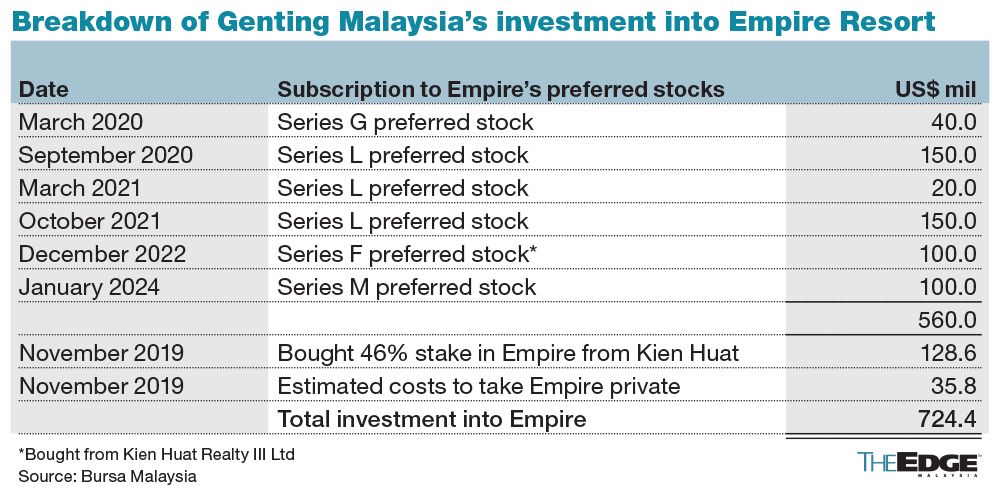

Genting Malaysia first bought a 46% stake in Empire Resorts, which has been loss-making for over two decades, from Kien Huat Realty III for US$128 million, cash, in 2019. Genting Malaysia's investments in Empire Resorts prior to the latest acquisition totalled US$724.4 million, after it made several capital injections through common and preferred stocks that were widely viewed as financial aid rather than investments.

Genting Malaysia said the acquisition will reinforce its position and grow its presence in New York State's gaming market. Full control over the Empire Resorts will also allow Genting Malaysia to better position the Resorts World brand through more effective cross-marketing between Resorts World New York City and Empire Resorts' assets, it added.

The proposed acquisition, funded via Genting Malaysia’s internally generated funds, is expected to be completed by the end of the second quarter of 2025, subject to regulatory approval from the New York State Gaming Commission.

The deal will have no impact on Genting Malaysia’s share capital but is expected to lift its earnings per share as at end-December 2024 (FY2024) from 4.43 sen to 5.29 sen, based on Genting Malaysia's audited financial statements for FY2024, and its net assets from RM11.92 billion to RM11.97 billion.

However, Genting Malaysia's total borrowings will increase to RM13.5 billion post-acquisition, up 10.44% from RM12.2 billion as at end-December 2024. Hence, Genting Malaysia's gearing will also increase to 1.13 times from 1.03 times.

Genting Malaysia’s share price settled four sen or 2.34% higher at RM1.75 on Friday, bringing the stock a market capitalisation of RM10.39 billion. Year to date, the stock has fallen 35%.

*The value of the deal has been amended for accuracy.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

Comments